Debt Management

The University issues debt to fund various capital projects, including land and building purchases. The issuance process and post-issuance compliance is the responsibility of this office. Internal guidelines have been established to ensure that each debt transaction of the University is completed in the most effective and professional manner, and in accordance with the highest standards of the industry, laws and governmental practices.

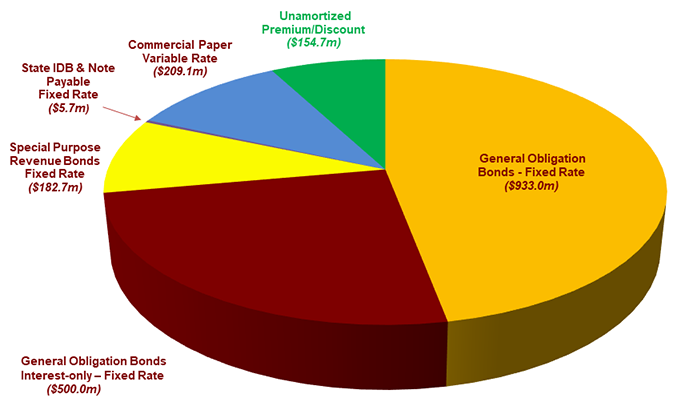

What is the U's outstanding debt balance?

Debt Profile as of June 30, 2022

$1.8 billion par outstanding; $1.6 billion University supported

Ratings:

Aa1 - Moody's

AA - S&P

Debt Ratings

Moody's

Aa1, with stable outlook (Moody's Investors Service)

Aa1 rating – The Aa1 rating reflects the University’s excellent brand and strategic positioning derived from its strong student and research market positions combined with ample financial resources.

Stable Outlook – reflects Moody's expectations of favorable student demand, tuition revenue and sponsored research trends. The outlook also incorporates longer term stable to improving EBIDA margins and debt service coverage.

- Moody's Rating Action dated 4-5-2022

- Moody's Credit Opinion dated 4-7-2022

- Moody's Rating Action - Series 2021C dated 9-2-2021

- Moody's Investors Service Credit Opinion for Series 2021C dated 9-9-2021

S&P Global Ratings

On January 22, 2024, S&P Global Ratings (S&P) affirmed the University's "AA" long-term rating with a stable outlook highlighting the University's position as Minnesota's flagship research University and land-grant institution, healthy financial resources, diverse revenue streams, low-to-moderate debt burden, and prodigious fundraising. In addition, S&P affirmed the University's "A-1+" short-term rating reflected by the University's own self-liquidity and credit quality. S&P acknowledges the soft enrollment trends, somewhat weak financial performance, and the uncertainty with its affiliation agreement with Fairview as offsetting factors.

The most recent rating report: S&P Global Ratings - Report dated 1-22-2024

Current Debt Reports/Liquidity

- 2023 Capital Finance and Debt Management Report

- Liquidity Letter December 31, 2023

- Liquidity Support (TIP) December 31, 2023

Current Official Statements

- Regents of the University of Minnesota, $500,000,000 April 11, 2022

- General Obligation Taxable Bonds, Series 2022

- Regents of the University of Minnesota, Commercial Paper Offering Memorandum November 9, 2021

- Regents of the University of Minnesota, $123,485,000 September 14, 2021

- Special Purpose Revenue Refunding Bonds, Series 2021A

- Special Purpose Revenue Taxable Refunding Bonds, Series 2021B

- Regents of the University of Minnesota, $36,875,000 September 15, 2021

- General Obligation Taxable Bonds, Series 2021C (Sustainability Bonds)

- Regents of the University of Minnesota, $116,000,000 October 14, 2020

- General Obligation Bonds, Series 2020A

- General Obligation Bonds, Series 2020B

Debt Management Support/Oversight

Debt Oversight Group (DOG)

The DOG supports and advises the Treasurer and Director of Debt Management in decisions regarding policy development, capital financing strategies, and debt capacity analysis. In addition, the committee periodically reviews the debt management processes to insure compliance with University and tax requirements. Meetings are scheduled monthly. University members in addition to the Treasurer and Director of Debt Management include the following individuals:

- Controller

- Tax Director

- Accounting Director

- Chief Investment Officer

- Associate General Counsel

- Assistant Vice President, University Services

Debt Process Team (DPT)

The DPT acts as the University's trustee to approve the draws on unspent bond proceeds to reimburse expenditures incurred on eligible projects. In addition, the group establishes and insures that appropriate accounting and compliance procedures are in place and working properly. Meetings are scheduled monthly. The team consists of representatives from applicable departments within the University that have a direct involvement in various aspects of debt management compliance. These departments include:

- University Services-Finance

- Treasury Accounting (within the Controller's Office)

- Treasury Operations (within the Office of Investments and Banking)

- University Tax Management

Debt Management Advisory Committee (DMAC)

The Debt Management Advisory Committee (the "Committee") advises the Finance Committee of the Board of Regents and the University's Treasurer on the issuance and ongoing management of debt. In doing so, the Committee evaluates, recommends, and monitors debt management policies, strategies, and guidelines and provides advice on their implementation so as to best serve the financial objectives of the University of Minnesota. A regent who is a member of the Finance Committee chairs the Advisory Committee. The President appoints the remaining members who consist of:

- The Treasurer of the University;

- A faculty member of the Carlson School of Management whose area of expertise is relevant to the work of the committee; and

- Up to six members of the local business community with relevant professional training and experience.

Debt Policies and Procedures

- Board of Regents Policy: Debt Transactions and Long-Term Capital Financing Program

- Debt Management Guidelines updated October 31, 2020

- IRMA Exemption: Independent Registered Municipal Advisor (IRMA) Exemption Notice June 15, 2022

Archived Debt Ratings

2021

- S&P Global Ratings - Report dated 4-5-2022

- S&P Global Ratings - Report for Series 2021C dated 9-7-2021

2020

- Moody's Investors Service Credit Opinion for Series 2020AB dated 10-13-2020

- Moody's Investors Service Rating Action for Series 2020AB dated 10-9-2020

- S&P Global Ratings - Report for Series 2020AB dated 10-6-2020

2019

- Moody's Investors Service - Rating Action for Series 2019A, B, C dated 4-12-19

- Moody's Investors Service - Credit Opinion dated 4-15-2019

- S&P Global Ratings - Report for Series 2019A, B, C dated 4-15-2019

2018

- Moody's Investors Service - $400 million Commercial Paper Program, Ratings Action dated 5-17-2018

- Moody's Investors Service Credit Opinion dated 5-17-2018

- S&P Global Ratings - $400 million Commercial Paper Program dated 5-24-2018

2017

- Moody's Investors Service - Ratings Report for Series 2017 A, B, C dated 8-25-2017

- S&P Global Ratings - Report for Series 2017 A, B, C dated 8-29-2017

- Moody's Investors Service - Ratings Report for Commercial Paper Notes dated 2-8-2017

- S&P Global Ratings - Ratings Report for Commercial Paper Notes dated 2-8-2017

2016

- Moody's Investors Service – Ratings Report for Series 2016A dated March 21, 2016

- Standard & Poor's – Ratings Report for Series 2016A dated March 16, 2016

2015

- Moody's Investors Service – Ratings Report for Series 2015B dated August 3, 2015

- Standard & Poor's – Ratings Report for Series 2015B dated August 5, 2015

Archived Official Statements

- Regents of the University of Minnesota, $175,455,000 April 23, 2019

- General Obligation Bonds, Series 2019A

- General Obligation Refunding Bonds, Series 2019B

- General Obligation Taxable Bonds, Series 2019C

- Regents of the University of Minnesota Commercial Paper Notes, Series A, B, C, D, E, F, G, H, I June 13, 2018

- Regents of the University of Minnesota, $423,290,000 September 13, 2017

- General Obligation Bonds, Series 2017A, $117,095,000

- General Obligation Refunding Bonds, Series 2017B, $292,955,000

- General Obligation Taxable Refunding Bonds, Series 2017C, $13,240,000

- Regents of the University of Minnesota, Commercial Paper Notes Series A, B, C, D and F, and Taxable Commercial Paper Notes, Series E February 8, 2017

- Regents of the University of Minnesota, General Obligation Bonds, Series 2016A, $122,475,000 March 29, 2016

- Regents of the University of Minnesota, Special Purpose Revenue Refunding Bonds (State Supported Stadium Debt), Series 2015A, $90,075,000 August 11, 2015

- Regents of the University of Minnesota, General Obligation Taxable Bonds, Series 2015B, $10,110,000 August 11, 2015

Archived Debt Reports/Liquidity

Liquidity Letters

- Liquidity Letter September 30, 2023

- Liquidity Letter June 30, 2023

- Liquidity Letter April 3, 2023

- Liquidity Letter February 1, 2023

- Liquidity Letter November 1, 2022

- Liquidity Letter August 1, 2022

- Liquidity Letter May 17, 2022

- Liquidity Letter November 23, 2021

- Liquidity Letter August 18, 2021

- Liquidity Letter May 5, 2021

- Liquidity Letter February 8, 2021

- Liquidity Letter November 10, 2020

- Liquidity Letter August 5, 2020

- Liquidity Letter June 1, 2020

- Liquidity Letter February 10, 2020

- Liquidity Letter November 2019

- Liquidity Letter August 2019

Liquidity Support

- Liquidity Support (TIP) September 30, 2023

- Liquidity Support (TIP) June 30, 2023

- Liquidity Support (TIP) March 31, 2022

- Liquidity Support (TIP) December 31, 2022

- Liquidity Support (TIP) September 30, 2022

- Liquidity Support (TIP) June 30, 2022

- Liquidity Support (TIP) March 31, 2022

- Liquidity Support (TIP) December 31, 2021

- Liquidity Support (TIP) September 30, 2021

- Liquidity Support (TIP) June 30, 2021

- Liquidity Support (TIP) March 31, 2021

- Liquidity Support (TIP) December 31, 2020

- Liquidity Support (TIP) September 30, 2020

- Liquidity Support (TIP) June 30, 2020

- Liquidity Support (TIP) March 31, 2020

- Liquidity Support (TIP) December 31, 2019

- Liquidity Support (TIP) September 30, 2019

- Liquidity Support (TIP) June 30, 2019

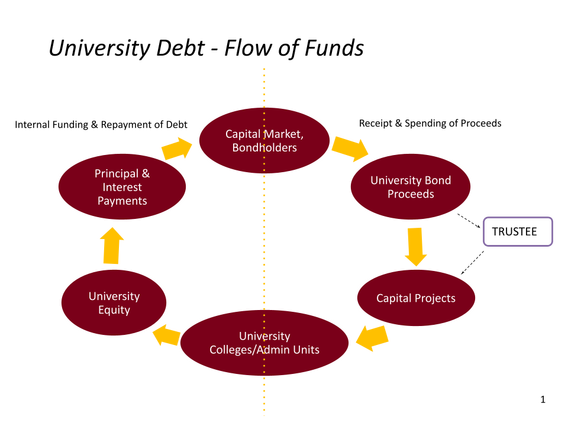

The flow of funds into and out of the University is depicted as a circle, starting and ending with the external bondholders in the capital markets.

Receipt and Spending of Proceeds

- University debt is sold in the capital markets to investors.

- Debt proceeds are received by the University and invested by the Office of Investments and Banking (OIB) prior to being spent on University capital projects.

- Most universities use an outside trustee who authorizes the draws on the proceeds for the capital projects. The University’s Debt Process Team acts as the University’s trustee.

Internal Funding and Repayment of Debt

- University colleges, auxiliary units and administrative units benefit from the capital projects and are charged debt service (principal and interest) for the use of debt on space that they occupy.

- The debt service charges are collected centrally and considered University equity.

- University equity is used to fund the principal and interest payments due to the bondholders.

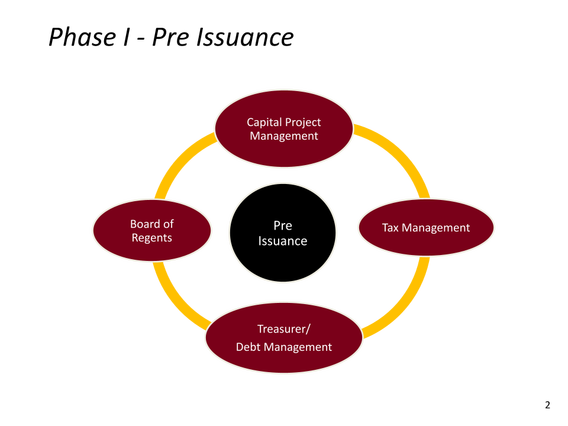

Phase I: Pre Issuance

the initial planning for a future debt issuance.

- Capital Project Management (CPM) performs project and cash flow analysis to determine the need for & timing of debt financing for various projects.

- The Office of Tax Management determines if there is private use on the project(s) as that may determine whether or not taxable debt is issued.

- The Debt Management Office calculates debt capacity, reviews the debt funding needs for projects being contemplated, and ensures there is a Declaration of Intent to Reimburse signed by the Treasurer.

- The Board of Regents approve the projects, approve the Resolution Related to Issuance of Debt, and approve the recommended underwriter(s) to be used for the future sale.

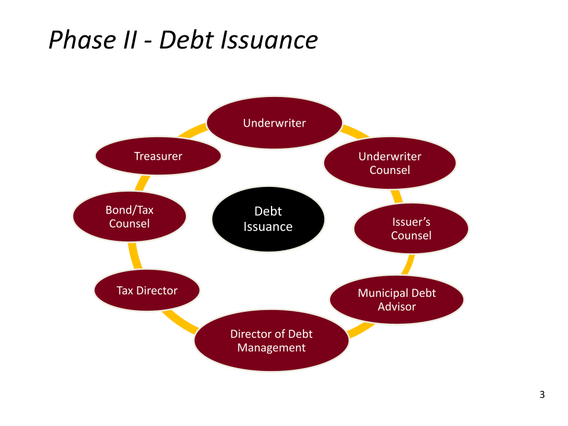

Phase II: Issuance

The University’s Treasurer has overall responsibility for the debt issuance. The working group involved in a negotiated sale of debt includes representatives from University Finance, including the Office of Tax Management, the external underwriter(s), underwriter’s counsel, issuer’s counsel (a member of the University’s Office of General Counsel), the University’s municipal debt advisor and the University’s bond counsel.

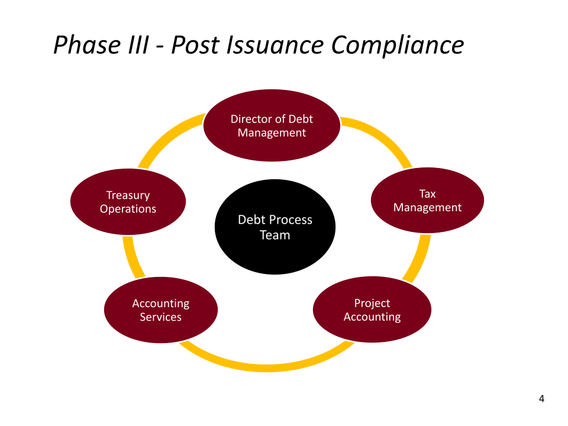

Phase III: Post Issuance Compliance

The individuals from different University units that are members of the Debt Process Team work together to act as the University’s trustee to approve draw requests and to oversee compliance after the debt is issued.

- The Office of Debt Management monitors the spending of the proceeds to determine if spending guidelines are met, ensures the Treasurer signs designation certificates where there are excess proceeds to be designated for a project not originally contemplated, maintains the bond documentation to be retained over the life of the bonds, and submits annual continuing disclosure.

- The Office of Tax Management oversees occupancy dates, timing regulations, performs arbitrage rebate and private use monitoring.

- Project Accounting tracks expenditures to projects and prepares draw requests.

- Treasury Operations (within OIB) invests the bond proceeds, draws the funds when the requests are approved, and makes the principal and interest payments to the bondholders.

- Accounting Services records all related general ledger entries associated with the draws and the allocation to specific projects.

Quick Links

- Private Business Use (PBU)/Tax (see section on Tax-Exempt Debt)

- Minnesota Management and Budget

- Capital Budget

Contact Us

Director: Arcelia Detert

Phone Number: 612-624-2858

[email protected]

Campus mail: 338 Morrill Hall MC 0263

100 Church St SE, 338 Morrill Hall, Minneapolis, MN 55455